"2018 will be a turning point for the investment market, especially from the perspective of the office segment. If so far, office buildings with an average surface area of 20,000 sqm were traded, the pipeline for the next period includes projects with an average surface area of over 50,000 sqm. Therefore, the volume of investment in the office market could increase from 160 million euros in 2017 to 500 million euros in 2018 ".

Also, the total estimated real estate investment volume for this year will exceed the EUR 1 billion threshold and returns for retail, office and industrial projects could fall by 25-50 basis points.

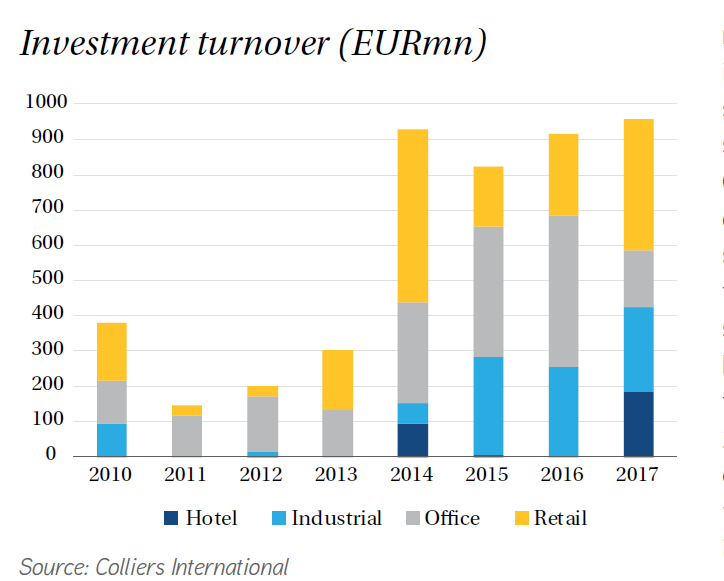

Economic growth has encouraged investors' interest in Romania, which has led to a qualitative improvement in the real estate market. However, the prolongation of the negotiation phase postponed some transactions for 2018, with liquidity in 2017 almost unchanged at 960 million euros. The largest transactions were the partnership between Iulius Group and Atterbury Europe (estimated at 200 million euros) and the sale of Radisson Blu to Cerberus Capital Management and Revetas Capital (169 million euros).

According to the new report, the dynamism of 2017 will continue in 2018 in the real estate market, being doubled by new demands and trends in the Capital and especially in the major regional cities in the country.

The market for industrial premises reached 3.5 million m2 of modern storage space last year, after the delivery of approximately 500,000 sqm in 2017, an acceleration of over 40% compared to 2016.

Of this total, half of it, namely 1.7 million sq m, was registered in Bucharest. The vacancy rate remained at 2% in Bucharest and below 5% in the country. Last year, rentals for 500,000 sq m of such spaces were concluded, of which almost 52% were in Bucharest, 14,6% in Timisoara and 12,4% in Pitesti. The largest demand came from the logistics area - 47%, followed by retail segments (17%) and auto (9%).

"There are still favorable conditions for the development of industrial spaces. Consequently, we estimate that this year the stock will grow by another 700,000 sqm nationwide and demand will come from logistics and online commerce and FMCG. The lack of infrastructure development will favor the concentration of spaces in the Capital's area, where deliveries of nearly 400,000 square meters are expected, but attention will also be directed to the central and western parts of the country providing immediate access to the Hungarian motorways", the quoted report concludes. (source: zf.ro)