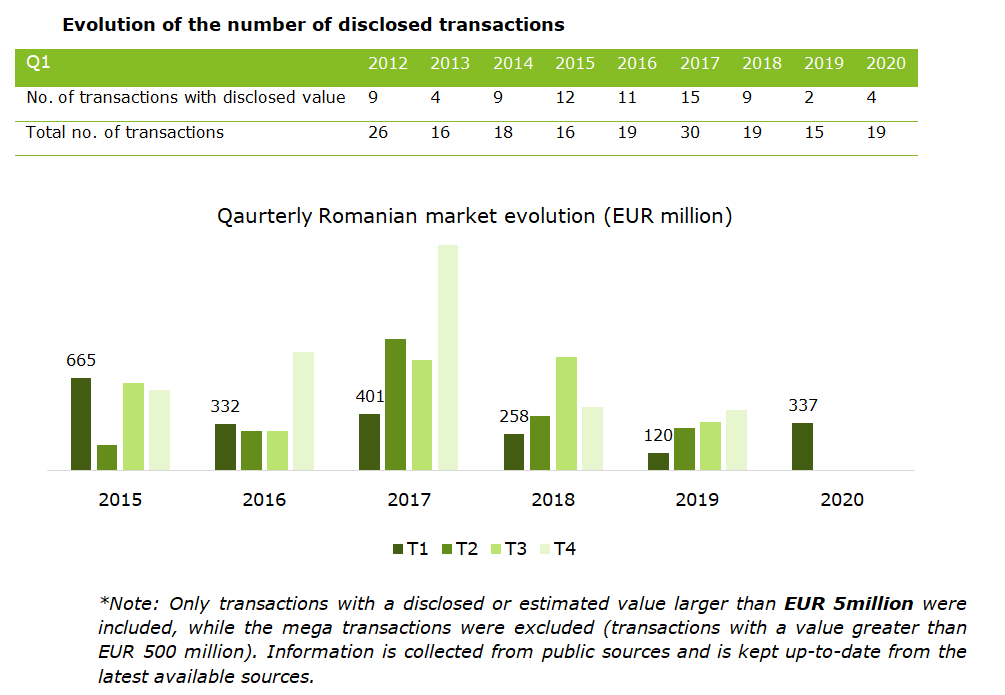

Out of the total 19 transactions, only four were announced in March, the month during which a state of emergency was declared in Romania in the context of the COVID-19 outbreak.

“Unfortunately, theseareunprecedented times, governed by uncertainty onall levels. In this context, our expectations for the M&A market can’tbe optimistic. Everything will depend on when and how this will end,” said Ioana Filipescu Stamboli, Partner Corporate Finance, Deloitte Romania.

Only four transactions with disclosed value were announced during the quarter and the tendency of non-reporting transactions values has remained strong.

The largest transactions announced in the first quarter of 2020 were:

- the acquisition by the Czech developer CPI Property Group SA of a minority stake in Globalworth, the largest owner of office buildings in Romania and Poland, in a series of successive transactions, the largest amounting to approximately EUR 280 million;

- the transfer by OMW Petrom, the largest energy company in South-Eastern Europe, of 40 onshore oil and gas deposits from Romania to Dacian Petroleum (undisclosed value);

- The Brink’s Company’s takeover of cash operations of the UK-based G4S in 14 markets, including Romania (undisclosed value for Romania).

The Romanian M&A market, in 2019

- market value (disclosed value transactions): EUR 337 million;

- estimated market value (including undisclosed transactions): EUR 600-750 million;

- number of transactions (including undisclosed transactions): 19;

- number of disclosed transactions: 4;

- average value (calculatedfor disclosed transactions): EUR 84 million;

(source: Deloitte)