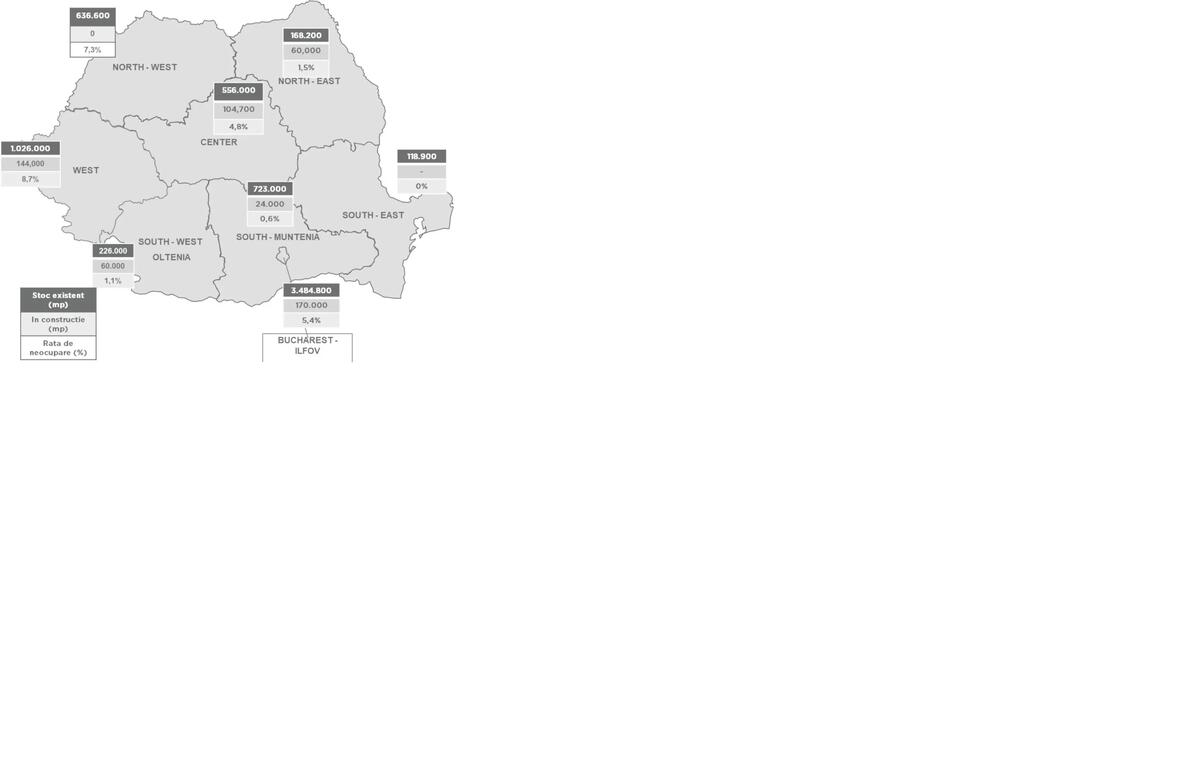

Developers have announced the delivery of more than 500,000 sq. m of new industrial and logistics parks in 2024, with Bucharest – Ilfov having the largest share (180,000 sq. m), followed by the West (144,000 sq. m) and Central (105,000 sq. m) regions.

The total annual take-up surpassed 1 million sq. m, in line with the levels reported in the 3 years beforehand, with almost 300,000 sq. m being transacted in Q4. Compared with 2022, the total take-up was 23% lower, due to challenges such as higher financing costs, elevated yield levels and difficulties in securing capital for development.

Andrei Brînzea, partner Land and Industrial Agency Cushman & Wakefield Echinox: “Companies are still cautious when it comes to expanding their footprints, thus prompting a hesitation in committing to new spaces. Therefore, the decision-making process is slower and closing transactions requires longer timeframes compared with the previous years. On the other hand, the current climate creates new business opportunities and we will witness the consolidation of operations into fewer, but larger buildings in order to reduce costs, increase the efficiency and improve the delivery processes. The expansion of online retail and the necessity for logistics properties to meet delivery demands are expected to persist going forward. Although the online retail sales growth has been relatively subdued in 2023, due to consumers scaling back their overall spending, forecasts indicate a return to a positive evolution in the coming years. Moreover, traditional retail networks will continue to be active on the leasing market, looking to adapt their online sales strategies.”

Consequently, the demand for logistics spaces aimed at streamlining retail supply chains is anticipated to remain strong going into 2024 and beyond.

Furthermore, space demand from manufacturers is also poised to persist, as the nearshoring trend (strategically moving production facilities closer to consumer markets) unfolds.

A significant structural shift impacting all property categories, including logistics, pertains to the occupiers’ requirements for spaces which prioritize sustainability. This shift will result in an increase in demand for sustainable projects.

The new demand was the main driver of the overall leasing activity, accounting for 66% (672,000 sq. m) of the 2023 gross take-up. As such, the share of new demand in the total gross take-up decreased in 2023 when compared with 2022 (85%).

Bucharest attracted 48% of the total take-up in 2023, with Timisoara (121,600 sq. m) being the only other location with a gross take-up exceeding 100,000 sq. m throughout the year. Brasov, Cluj, Ploiesti, Sibiu and Pitesti were the other locations where companies leased significant industrial and logistics spaces. Logistics and distribution operators were the most active players on the market, with 300,000 sq m. of warehouse spaces being leased, followed by automotive (106,000 sq. m), retail, e-commerce and FMCG companies with 93,000 sq. m and pharma (41,000 sq. m).

The prime headline rents in Bucharest and in the main industrial & logistics destinations in Romania slightly increased at levels ranging between €4.30 – €4.70/ sq. m/ month in Q4 2023, an upward trend which is expected to continue going forward.

Speculative development is due to slow down, partly because of the developers’ cautious approach aimed at preventing market oversupply following the new demand deceleration.