In order to achieve this position, the investor spent approx. EUR 150 million, money that could buy a mall like Promenada Bucharest or two office buildings like BOB and BOC near the metro station Pipera. In other words, this kind of ascension is impossible to replicate on the office or retail sectors.

„On the industrial segment such a big market share could be reached in such a short time with less capital, as the market was fragmented and the value of assets is lower. On retail and office segments, in order to reach the top market leaders, largest amounts are needed. And the duration of the transactions in order to accumulate such a portfolio is also longer“, has declared Andrei Văcaru, capital markets consultant & head of research within JLL.

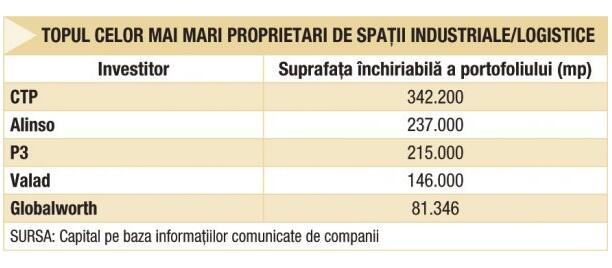

On short term, the only predictable modification of the logistic owners top comes from the company P3. After the acquisition of Europolis Logistics Park, which propelled the investor directly on the third position, P3 started the expansion of the project with another warehouse facility.

After its completion, scheduled for April 2016, the company will climb the second position, outrunning the Belgian company Alinso. The contracts of expansion Globalworth has for Timişoara Airport Park will increase the area of the project to 123,400 sq. m, not enough however to exceed the dimension of the two parks Valad owns near Bucharest.

If the new owners of Valad, the Australian fund Cromwell, still didn’t give signs of continuing the expansion in Romania, Alinso continue to expand Ploieşti West Park, but only build-to-suit and also selling the property to the solicitor, a reason for the portfolio’s area could remain unchanged. New players entering the market by acquiring the industrial properties of Immofinanz will not change the top on short term. However, Logicor, the company which entered in exclusive negotiations with Immofinanz, has over 110 ha available for expanding the current area of approx. 52,000 sq. m.

The effervescence of the real estate market in the last months, which makes the consultants to expect for this year total transactions of EUR 800 million, is pushing even more the new leaders. The three investors will continue to increase their portfolios, but the attention is changing from acquisitions to projects development. „Regardless the acquisitions to me made, the new leader will continue to consolidate their market share by through their ongoing developments“, considers Andrei Văcaru.

Apart the five logistic parks bought this year, CTP also acquired nearly 90 hectares for expansion. The new target of the investor is to reach assets of more than EUR 250 million in Romania. In such an environment, the only predictable way for new investors to show on the market is by making acquisitions, as the already existing players have insured consistent land areas for future developments.

„Those who will start new developments will be especially players familiar with the market. However there are also regional groups which analyze carefully potential developments in Romania and which intend to enter the local market by acquiring lands or projects“, concludes the JLL’s consultant. (source: capital.ro)