Romanian investors Dragos and Adrian Paval, who control Dedeman, recently said they planned to invest in real estate and smaller Romanian companies. They are rumored to be interested in buying the five AFI Park office buildings developed by Israeli group AFI Europe next to the ADI Palace Cotroceni mall in Bucharest.

Dragos Paval, one of Dedeman’s founders, will also hold a position in the board of administration of Cluj-Napoca-based Cemacon, according to information on the company’s website.

Dedeman bought the Cemacon stake from Finnish investment fund KJK, which sold its 27.9% of the company’s shares on February 7, for EUR 2.19 million. Local brokerage firm BRK Financial Group also sold its 14.6% stake in Cemacon on the same day for EUR 1.15 million.

Meanwhile, two of Cemacon’s biggest shareholders increased their stakes. Business Capital for Romania Opportunity Fund, an investment vehicle controlled by Austrian group Erste and local investor Florin Pogonaru, increased its stake from 27.8% to just under 33% of Cemacon’s shares. Andrei Cionca, one of the owners of the CITR group, one of the top players on the local insolvency and restructuring market, also increased his indirect stake in Cemacon from 25.4% to 30%.

The deals were concluded on the Bucharest Stock Exchange (BVB) at a price of RON 0.31 per share. Meanwhile, the price of the Cemacon shares went up by some 30%, to RON 0.426, on Friday, February 10. The company has thus reached a market capitalization of almost EUR 10 million.

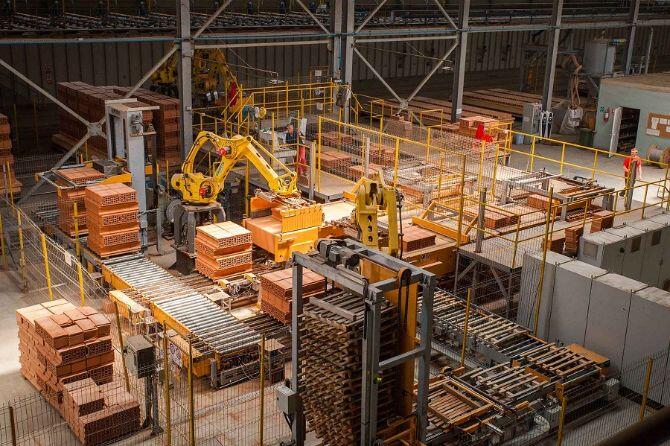

Cemacon had big financial problems after the 2008 financial crisis as it had to repay a big loan to BCR which it had taken during the boom years to build a new brick factory in Recea, Salaj county. The company’s main shareholders, namely KJK, Broker Cluj, and Andrei Cionca managed to restructure it without going into insolvency, which seemed inevitable at one point. BCR agreed to restructure de loan and convert some of it into shares, which were taken by Business Capital for Romania Opportunity Fund.

Meanwhile, the company also improved its operational results. It posted a turnover of EUR 19.2 million in 2016, up 28% over the previous year, and its net profit grew from EUR 150,500 to EUR 1.1 million. The evolution was linked to the recovery of the local construction market. The company also sold two land plots in Zalau to Dedeman, for about EUR 1.1 million. (source: Romania-insider.com)