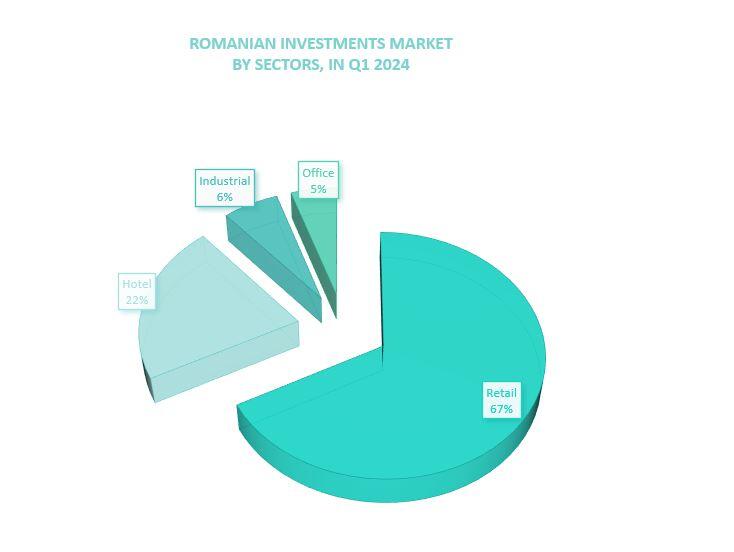

Large real estate buyers have placed 67% of their total investments in retail assets, ranging from retail portfolios on the ground floor of apartment blocks to the largest shopping centre in Romania, Expo Market Doraly.

The stores acquired in the first quarter are in Bucharest, Cluj-Napoca, Râmnicu - Vâlcea and Iași.

"In the first quarter of 2024, investor interest was focused on the retail segment with food retail and retail parks as the formats that proved resilient. At the same time, due to lower coupons and stable yields, investment products in the food retail segment or small retail parks attract local investors. On the other hand, industrial and logistics assets continue to be the focus of negotiations, due to the relatively low stock compared to other countries in the CEE region and the forecast of increasing demand in this segment due to infrastructure development in recent years and Romania's entry into Schengen.

For the year 2024, we estimate that the highest volume of investments will be made in the industrial segment, while in the office segment, some assets will become attractive, due to the drastically reduced deliveries forecast for the coming years'', says Ștefan Oană, Head of Capital Markets at Fortim Trusted Advisors, a member of the BNP Paribas Real Estate Alliance.

In Bucharest, real estate investments amounted to €141.25 million, which represents 68% of the total investments in the whole country.

The largest investment in Bucharest and the country is the acquisition of Expo Market Doraly in Bucharest by the Belgian company WDP, second place is the Hotel Ambasador, also in Bucharest, bought by the Austrian company Julius Meinl and third place is the portfolio of 17 street shops in Cluj-Napoca traded for €24.3 million.

The office transaction market is between two waves

This quarter, only one office building, an architectural monument located in the University area of the capital, Ion Câmpineanu Street, was traded. The 5,000 sqm building, renovated in 2016 to modern standards and with commercial space on the first levels, was traded for €10.5 million.

Going forward to 2024, we expect that the interest of some owners of large real estate portfolios to create liquidity will generate large transaction opportunities in the industrial and office segments. In the medium term for Romania, political stability, economic growth and infrastructure development will continue to provide investment opportunities with higher returns," adds Ștefan Oană, Head of Capital Markets at Fortim Trusted Advisors, a member of the BNP Paribas Real Estate Alliance.

Fortim Trusted Advisors, an alliance member of the BNP Paribas Real Estate in Romania, is a real estate consulting company founded in 2002 and controlled since December 2020 by Costin Nistor, Bogdan Cange and Nicolae Ciobanu. The company provides real estate consulting services in the office, retail, industrial & logistics segments, evaluations, capital markets, research, but also Property Management and Project Management services. On the Property Management area, the company manages over 136,798 sqm of office, retail and industrial spaces. Among the most important recurring clients of Fortim Trusted Advisors are found Morgan Stanley, Add Value Management, Indotek, KÉSZ and First Property Asset Management. Also, on the office segment, the company handled the trading of premises for Reckit Benkiser, Renault, Fortech, Grohe, Credius, OLX Group, Multinode Network, AHI Carrier, AVL, UMT Software, Future Electronics, The Home or Bioderma.